Sales Tax Rate For Berkeley County Sc . the statewide sales & use tax rate is six percent (6%). The december 2020 total local sales tax rate. berkeley county, south carolina has a maximum sales tax rate of 9% and an approximate population of 98,077. There are a total of. the current sales tax rate in berkeley county, sc is 9%. 424 rows south carolina has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3%. the current total local sales tax rate in berkeley county, sc is 8.000%. This is the total of state, county, and city. Counties may impose an additional one percent (1%) local sales tax. Click for sales tax rates, berkeley county sales tax calculator, and. the minimum combined 2024 sales tax rate for berkeley county, south carolina is 9.0%. this form provides a list of south carolina municipalities that impose local sales and use taxes, along with each municipality's tax rate.

from www.buyhomesincharleston.com

This is the total of state, county, and city. The december 2020 total local sales tax rate. the statewide sales & use tax rate is six percent (6%). this form provides a list of south carolina municipalities that impose local sales and use taxes, along with each municipality's tax rate. Click for sales tax rates, berkeley county sales tax calculator, and. the minimum combined 2024 sales tax rate for berkeley county, south carolina is 9.0%. the current sales tax rate in berkeley county, sc is 9%. There are a total of. berkeley county, south carolina has a maximum sales tax rate of 9% and an approximate population of 98,077. the current total local sales tax rate in berkeley county, sc is 8.000%.

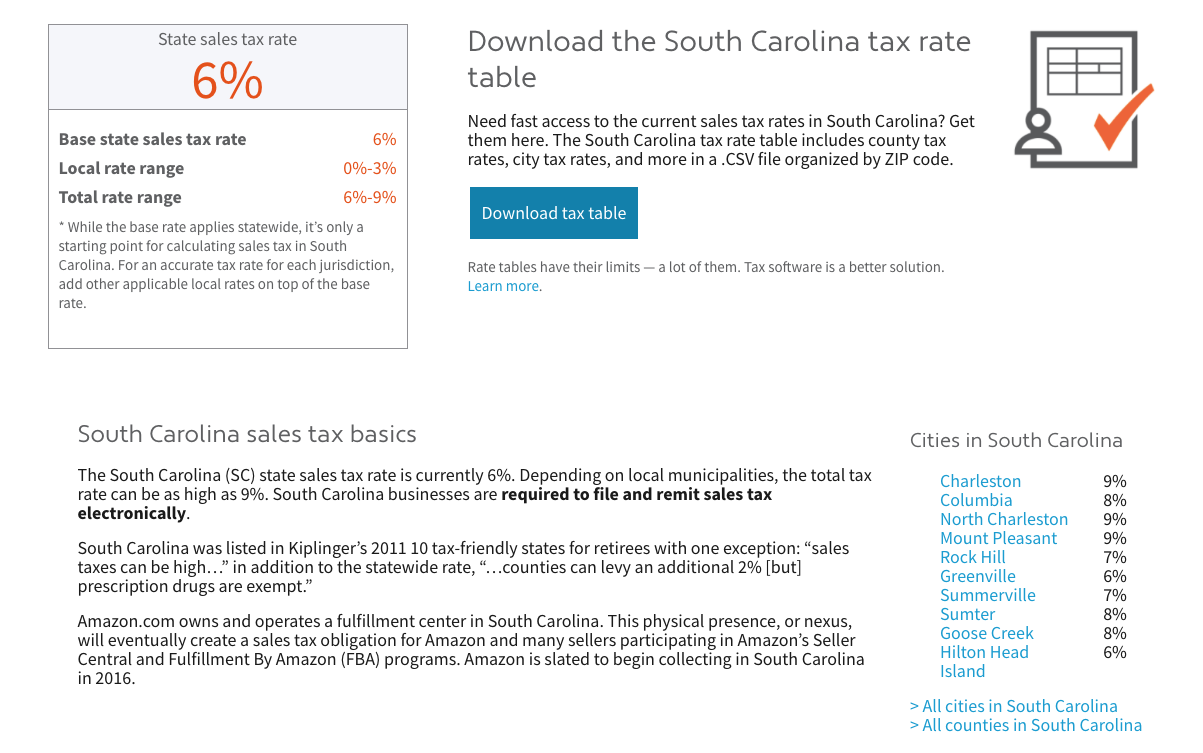

What is the Sales Tax Rate in South Carolina?

Sales Tax Rate For Berkeley County Sc Click for sales tax rates, berkeley county sales tax calculator, and. This is the total of state, county, and city. the statewide sales & use tax rate is six percent (6%). berkeley county, south carolina has a maximum sales tax rate of 9% and an approximate population of 98,077. the current total local sales tax rate in berkeley county, sc is 8.000%. 424 rows south carolina has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3%. There are a total of. Counties may impose an additional one percent (1%) local sales tax. The december 2020 total local sales tax rate. the current sales tax rate in berkeley county, sc is 9%. the minimum combined 2024 sales tax rate for berkeley county, south carolina is 9.0%. Click for sales tax rates, berkeley county sales tax calculator, and. this form provides a list of south carolina municipalities that impose local sales and use taxes, along with each municipality's tax rate.

From taxfoundation.org

Combined State and Average Local Sales Tax Rates Tax Foundation Sales Tax Rate For Berkeley County Sc The december 2020 total local sales tax rate. berkeley county, south carolina has a maximum sales tax rate of 9% and an approximate population of 98,077. the minimum combined 2024 sales tax rate for berkeley county, south carolina is 9.0%. the statewide sales & use tax rate is six percent (6%). There are a total of. . Sales Tax Rate For Berkeley County Sc.

From www.exemptform.com

Berkeley County Property Tax Homestead Exemption ZDOLLZ Sales Tax Rate For Berkeley County Sc the minimum combined 2024 sales tax rate for berkeley county, south carolina is 9.0%. The december 2020 total local sales tax rate. the current total local sales tax rate in berkeley county, sc is 8.000%. the current sales tax rate in berkeley county, sc is 9%. 424 rows south carolina has state sales tax of 6%,. Sales Tax Rate For Berkeley County Sc.

From www.mapsofworld.com

What is the Combined State and Local Sales Tax Rate in Each US State Sales Tax Rate For Berkeley County Sc the statewide sales & use tax rate is six percent (6%). 424 rows south carolina has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3%. This is the total of state, county, and city. Click for sales tax rates, berkeley county sales tax calculator, and. Counties may. Sales Tax Rate For Berkeley County Sc.

From exooutykh.blob.core.windows.net

Property Tax Estimator Berkeley County Sc at Dennis Rumph blog Sales Tax Rate For Berkeley County Sc the minimum combined 2024 sales tax rate for berkeley county, south carolina is 9.0%. Click for sales tax rates, berkeley county sales tax calculator, and. 424 rows south carolina has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3%. Counties may impose an additional one percent (1%). Sales Tax Rate For Berkeley County Sc.

From printablefernandezfg9324.z14.web.core.windows.net

North Carolina Tax Rates 2024 Sales Tax Rate For Berkeley County Sc this form provides a list of south carolina municipalities that impose local sales and use taxes, along with each municipality's tax rate. This is the total of state, county, and city. the statewide sales & use tax rate is six percent (6%). the current total local sales tax rate in berkeley county, sc is 8.000%. 424. Sales Tax Rate For Berkeley County Sc.

From exooutykh.blob.core.windows.net

Property Tax Estimator Berkeley County Sc at Dennis Rumph blog Sales Tax Rate For Berkeley County Sc this form provides a list of south carolina municipalities that impose local sales and use taxes, along with each municipality's tax rate. the current total local sales tax rate in berkeley county, sc is 8.000%. Counties may impose an additional one percent (1%) local sales tax. Click for sales tax rates, berkeley county sales tax calculator, and. The. Sales Tax Rate For Berkeley County Sc.

From quizzfullclassantstf.z14.web.core.windows.net

North Carolina Sales Tax Rates 2023 Sales Tax Rate For Berkeley County Sc Counties may impose an additional one percent (1%) local sales tax. this form provides a list of south carolina municipalities that impose local sales and use taxes, along with each municipality's tax rate. the current sales tax rate in berkeley county, sc is 9%. berkeley county, south carolina has a maximum sales tax rate of 9% and. Sales Tax Rate For Berkeley County Sc.

From taxwalls.blogspot.com

Berkeley County South Carolina Sales Tax Rate Tax Walls Sales Tax Rate For Berkeley County Sc There are a total of. This is the total of state, county, and city. the current sales tax rate in berkeley county, sc is 9%. the minimum combined 2024 sales tax rate for berkeley county, south carolina is 9.0%. Counties may impose an additional one percent (1%) local sales tax. this form provides a list of south. Sales Tax Rate For Berkeley County Sc.

From www.aarp.org

States With Highest and Lowest Sales Tax Rates Sales Tax Rate For Berkeley County Sc this form provides a list of south carolina municipalities that impose local sales and use taxes, along with each municipality's tax rate. the current total local sales tax rate in berkeley county, sc is 8.000%. the statewide sales & use tax rate is six percent (6%). The december 2020 total local sales tax rate. the minimum. Sales Tax Rate For Berkeley County Sc.

From taxwalls.blogspot.com

Berkeley County South Carolina Sales Tax Rate Tax Walls Sales Tax Rate For Berkeley County Sc the minimum combined 2024 sales tax rate for berkeley county, south carolina is 9.0%. this form provides a list of south carolina municipalities that impose local sales and use taxes, along with each municipality's tax rate. the statewide sales & use tax rate is six percent (6%). The december 2020 total local sales tax rate. Counties may. Sales Tax Rate For Berkeley County Sc.

From taxfoundation.org

2022 Sales Tax Rates State & Local Sales Tax by State Tax Foundation Sales Tax Rate For Berkeley County Sc This is the total of state, county, and city. berkeley county, south carolina has a maximum sales tax rate of 9% and an approximate population of 98,077. the current total local sales tax rate in berkeley county, sc is 8.000%. this form provides a list of south carolina municipalities that impose local sales and use taxes, along. Sales Tax Rate For Berkeley County Sc.

From quizzdbbackovnc.z13.web.core.windows.net

State And Local Sales Tax Rates 2020 Sales Tax Rate For Berkeley County Sc Counties may impose an additional one percent (1%) local sales tax. There are a total of. This is the total of state, county, and city. the statewide sales & use tax rate is six percent (6%). Click for sales tax rates, berkeley county sales tax calculator, and. 424 rows south carolina has state sales tax of 6%, and. Sales Tax Rate For Berkeley County Sc.

From cloqnichol.pages.dev

Berkeley County Sales Tax 2024 Adena Brunhilde Sales Tax Rate For Berkeley County Sc this form provides a list of south carolina municipalities that impose local sales and use taxes, along with each municipality's tax rate. The december 2020 total local sales tax rate. the current sales tax rate in berkeley county, sc is 9%. Click for sales tax rates, berkeley county sales tax calculator, and. berkeley county, south carolina has. Sales Tax Rate For Berkeley County Sc.

From berkeleycountysc.gov

Berkeley County to Hold Delinquent Tax Sale December 6 in Nexton Sales Tax Rate For Berkeley County Sc The december 2020 total local sales tax rate. the current sales tax rate in berkeley county, sc is 9%. the current total local sales tax rate in berkeley county, sc is 8.000%. Click for sales tax rates, berkeley county sales tax calculator, and. 424 rows south carolina has state sales tax of 6%, and allows local governments. Sales Tax Rate For Berkeley County Sc.

From printable.mist-bd.org

Printable Sales Tax Chart Sales Tax Rate For Berkeley County Sc There are a total of. the current total local sales tax rate in berkeley county, sc is 8.000%. This is the total of state, county, and city. Click for sales tax rates, berkeley county sales tax calculator, and. 424 rows south carolina has state sales tax of 6%, and allows local governments to collect a local option sales. Sales Tax Rate For Berkeley County Sc.

From www.theassessor.org

Tax Districts Sales Tax Rate For Berkeley County Sc berkeley county, south carolina has a maximum sales tax rate of 9% and an approximate population of 98,077. The december 2020 total local sales tax rate. the current total local sales tax rate in berkeley county, sc is 8.000%. 424 rows south carolina has state sales tax of 6%, and allows local governments to collect a local. Sales Tax Rate For Berkeley County Sc.

From taxfoundation.org

Monday Map State and Local Sales Tax Rates, 2011 Tax Foundation Sales Tax Rate For Berkeley County Sc The december 2020 total local sales tax rate. This is the total of state, county, and city. the current sales tax rate in berkeley county, sc is 9%. Counties may impose an additional one percent (1%) local sales tax. this form provides a list of south carolina municipalities that impose local sales and use taxes, along with each. Sales Tax Rate For Berkeley County Sc.

From www.youtube.com

How To Calculate Find The Sales Tax Rate Or Percentage Formula For Sales Tax Rate For Berkeley County Sc Click for sales tax rates, berkeley county sales tax calculator, and. the statewide sales & use tax rate is six percent (6%). the minimum combined 2024 sales tax rate for berkeley county, south carolina is 9.0%. This is the total of state, county, and city. the current total local sales tax rate in berkeley county, sc is. Sales Tax Rate For Berkeley County Sc.